When should you start planning for a life after work?

Retirement might seem far off, but starting early is key. The sooner we plan, the better our golden years will be. It's important to consider when to start planning for life after work. After all, many of us want a comfortable and fulfilling retirement1.

Key Takeaways from this Article:

Retirement planning should begin early in one's career for maximum flexibility and control.

Understanding all retirement options, including phased retirement and early retirement, is essential.

Seeking specialist financial advice can make a significant difference in crafting a comprehensive retirement plan.

Coordinating retirement planning with a spouse or loved one ensures shared goals and a holistic approach.

Retirement age is currently set at 55, scheduled to rise to 57 from 6 April 20281.

Understanding the Importance of Early Financial Preparation

Planning for a comfortable retirement is key. Starting to save early can greatly increase your savings. This is because of compound interest, which grows your money over time2.

Building a strong financial base is vital. Regular savings and smart investments help you reach your retirement goals. They also offer a safety net for life's surprises. Contributing to 401(k) plans can also boost your savings with employer help and tax benefits2.

Setting clear retirement goals is crucial. Knowing your State Pension, expected costs, and income sources helps you plan. Diversifying your investments can also lead to better returns over the long term2.

The Power of Compound Interest Over Time

Compound interest can make a big difference in your savings. Saving early lets your money grow faster. This means a bigger nest egg for your retirement2.

Building a Strong Financial Foundation

A solid financial base is essential for a good retirement. Regular savings, smart investments, and using employer benefits are key. These steps help build a strong financial foundation2.

Setting Realistic Retirement Goals

Knowing your expenses, income, and State Pension helps set realistic goals. Aligning your savings with these goals ensures a secure retirement2.

“It's never too early to start planning for your retirement. The earlier you begin, the more time your money has to grow through the power of compound interest." - Financial Advisor

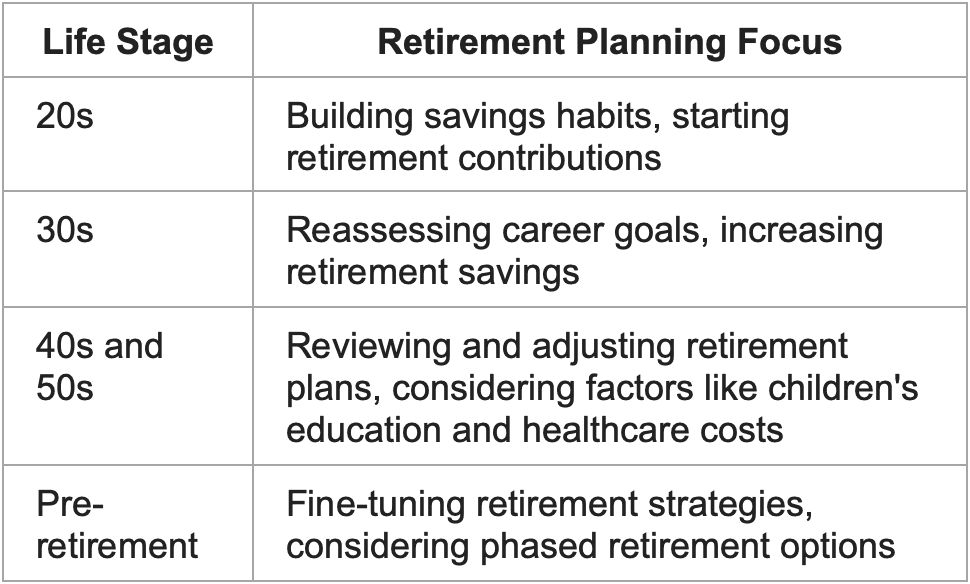

Key Life Stages for Retirement Planning

Retirement planning is a lifelong journey. It's important to think about different life stages to plan well. In our 20s, we should start saving and making small retirement contributions3. As we get into our 30s, we need to look at our career goals and save more, using compound interest to our advantage4.

In our 40s and 50s, we should check and update our retirement plans. We need to think about our children's education and healthcare costs5. Getting professional advice at this stage can also help keep our plans on track4.

When we're close to retirement, we should focus on making our plans even better. Thinking about phased retirement can help us smoothly move into retirement5. Keeping a balance between work and retirement planning at each stage is key to a secure and happy retirement.

“Retirement planning is a lifelong journey, and considering various life stages can help us navigate this process effectively.”

Essential Components of a Comprehensive Retirement Strategy

Planning for life after work is key. We need a retirement strategy that covers all financial bases. This includes diversifying investments, assessing pensions, and setting up an emergency fund for stability.

Investment Portfolio Diversification

Diversifying our investments is crucial for managing risk and boosting retirement income. By spreading our assets across different areas, we shield our savings from market ups and downs and aim for better returns.6 Younger investors can take on more risk for higher growth6.

Pension and Benefits Assessment

It's important to regularly check our pension and retirement benefits. Social Security aims to replace about 40% of our pre-retirement income in the U.S.6 We also need to think about extra insurance and taxes on our retirement income7. Getting advice from a retirement expert five or six years before retirement can be very helpful8.

Emergency Fund Requirements

Having an emergency fund is vital for financial stability in retirement. It helps with unexpected costs, like healthcare, which are a big part of retirement spending7. Also, checking for other insurance needs, like umbrella and life insurance, as retirement approaches adds protection.7

By including these key elements in our retirement plan, we can confidently move from work to a secure and fulfilling retirement.

"Retirement planning is not a one-size-fits-all approach. It's a dynamic process that requires regular assessment and adaptation to our changing needs and circumstances."

Balancing Career and Retirement Planning

It's vital to find a balance between our careers and retirement plans. Our work-life balance and financial goals are closely connected. The choices we make today can greatly affect our future happiness9.

Improving our skills can open up new career paths. This can lead to better pay and help us reach our financial goals10. But, we must weigh the pros and cons of high-stress jobs against our quality of life. Looking into part-time work or phased retirement can make our transition smoother10.

When planning for retirement, think about how your career choices will impact your finances. Adjusting your retirement plans for career changes can keep you on track. This way, you can enjoy your retirement as you envision10.

Retirement coaching services are key in guiding us to a fulfilling post-work life. They help us deal with the emotional and practical sides of retirement. This ensures we keep a good balance and find joy in our retirement activities9.

By balancing our career and retirement plans, we can look forward to a secure and purposeful future. This approach lets us craft a retirement that matches our values and dreams910.

Making the Transition from Work to Retirement

Switching from a long career to retirement is both thrilling and emotional. With more people working longer, planning for retirement gets tougher11. It's key to be ready emotionally and mentally for this big change.

Emotional and Psychological Preparation

Leaving work can bring out a mix of feelings, from joy to worry. It's important to face and deal with these emotions. With longer lives, we need to plan finances for retirement further ahead11. A positive mindset and openness to change can make retirement happy11.

Developing New Routines and Interests

Without a daily job, some may feel bored or anxious. Finding new hobbies or activities can help11. Staying active, whether through hobbies, helping others, or part-time jobs, keeps both body and mind healthy11.

Managing Lifestyle Changes

Retirement means big changes in how we live and socialise. It's important to handle these changes well. Downsizing, changing careers, or part-time work can ease the transition11. Making a budget for retirement and using senior discounts are smart money moves11.

Getting ready for retirement needs emotional, mental, and practical steps. By starting new routines, trying new things, and adjusting to lifestyle changes, retirees can look forward to this new phase with confidence and happiness.

"Retirement is not the end of the road. It is the beginning of the open highway." - Unknown

Conclusion

Our journey through retirement planning has shown us the key to success. It's about starting early, regularly checking our plans, and being flexible. A good plan looks at our money, emotions, and lifestyle for the future12.

Starting to plan for retirement in our 20s or 30s is a smart move. It lets us use compound interest to grow our savings over time12. But, it's also good to start later, even if we have to save more12.

As we go through life, keeping a solid retirement plan is essential. It should include a mix of investments, a check on our pensions, and savings for emergencies12. Getting advice from financial planners can help us figure out how much we need for retirement12. They consider things like inflation, healthcare, travel, and hobbies12.

By balancing work and retirement planning, we can make a smooth transition. This is both emotionally and financially easier13.

FAQs

When should retirement planning begin?

You should start planning for retirement early in your career. It's never too early or too late to start. Planning early helps you make better decisions as you get older.

What are the key considerations for retirement planning?

It's important to understand all your options, like phased or early retirement. Getting advice from a financial expert can really help. Planning together with a partner or loved one is key for shared goals.

Why is early financial preparation crucial for a comfortable retirement?

Saving early lets compound interest work in your favour. It builds a strong financial base through regular savings and investments. Setting clear retirement goals helps you save more effectively.

How should retirement planning be approached at different life stages?

In your 20s, start saving and contributing to retirement. In your 30s, review your career and boost your retirement savings. By your 40s and 50s, update your retirement plans, thinking about education and healthcare costs.

As you near retirement, refine your strategy and look into phased retirement.

What are the essential components of a comprehensive retirement strategy?

A good strategy includes a mix of investments to manage risk. It's important to regularly check your pension and other income sources. Having an emergency fund keeps you financially stable.

Think about different income sources, like pensions, investments, and part-time work.

How can one balance career progression with retirement planning?

Think about how your career choices affect your financial future. Keeping your skills up can lead to better jobs and more money. Weigh the pros and cons of stressful, high-paying jobs against your quality of life.

Consider how changing careers might impact your retirement plans and adjust your strategy.

What are the key considerations for the transition to retirement?

Find new interests and routines to keep you engaged. Manage lifestyle changes well, including your daily routine and social life. Think about how retirement will affect your relationships and plan for that.

Try new hobbies or volunteer to stay active and involved.

Are you ready to embrace this next chapter with clarity and intention? If you want to bring growth, health, and joy to your later years, check out our three-day Reflective Retreat that’s designed specifically for people just like you.

Click here to find out more: https://www.henleytraining.co.uk/reflective-retreats

Source Links

https://www.standardlife.co.uk/articles/article-page/planning-for-retirement

https://liberty-partnership.co.uk/blog/why-is-retirement-planning-important/

https://www.investopedia.com/terms/r/retirement-planning.asp

https://www.hsbc.com.mt/investments/life-cycle-retirement-planning/

https://myccmi.com/2023/05/a-guide-to-comprehensive-retirement-planning/

https://www.pantheralife.co.uk/maintaining-your-work-life-balance-in-retirement/

10.https://www.beaumontwealth.co.uk/retirement-balance-purpose-fulfilment/

https://www.britishseniors.co.uk/over-50-life-insurance/transitioning-to-retirement/